credit provides an important source of financing for __

Each month the entrepreneur pays for various business-related expenses on a credit card. In fact the use of credit cards is the most common source of finance amongst small businesses.

Sources Of Financing Business 5 Finance Source For Business

Equity Financing and Debt Financing.

. Funds required for inventory can be met through it but not others like plant and machinery land and building or salaries of employees etc. Some common source of financing business is Personal investment business angels assistant of government commercial bank loans financial bootstrapping buyouts. Short-term financing is most common for financing of current assets such as accounts receivable and inventories.

Usually an inexpensive source of external financing. Trade credit loans from commercial banks and commercial papers are some of the examples of the sources that provide funds for short duration. It was set up with the aim of facilitating the complete credit.

These banking opportunities allowed farmers to take different credit services facilities and various loans to meet their production requirements. B in financial markets helps to explain why equity is a relatively important source of finance for American business. Trade credit loans from commercial banks and commercial papers are some of the examples of the sources that provide funds for short duration.

The organization is relieved from the task of collection of bad debt. And buyers credit where the importer is given credit under the line of credit by your. By contrast for innovative high-growth companies and start-ups equity financing is essential.

At times the factor also provides finance to the company that is he makes advance payment of the debts taken by him to the. It works like this. A firm customarily buys its supplies and materials on credit from other firms recording the debt as an account payable.

A cheaper source of finance as compared to other means such as bank credit. Which one of the following financial instruments generally provides the largest source of short-term credit for small firms. Factoring is a financial transaction between a business owner and a third party that provides instant cash to the former in exchange for the account receivables of the business.

The most important direct sources of external financing for SMEs are credit lines bank loans and leasing. Business finance - business finance - Short-term financing. Sources of Financing for small business or startup can be divided into two parts.

Suppliers Credit Buyers Credit. There are also two distinct forms of financing you can tap - suppliers credit where the exporters bank finances the exporter with the full amount of the invoice while the importer can make payment in instalments to the exporters banker. A have advantages in overcoming the free-rider problem helping to explain why indirect finance is a more important source of business finance than direct finance.

B play a greater role in moving funds to corporations than do securities markets as a result of their ability to overcome the free-rider problem. Let us discuss the sources of financing business in greater detail. Here are a few major credit sources of rural credit in India.

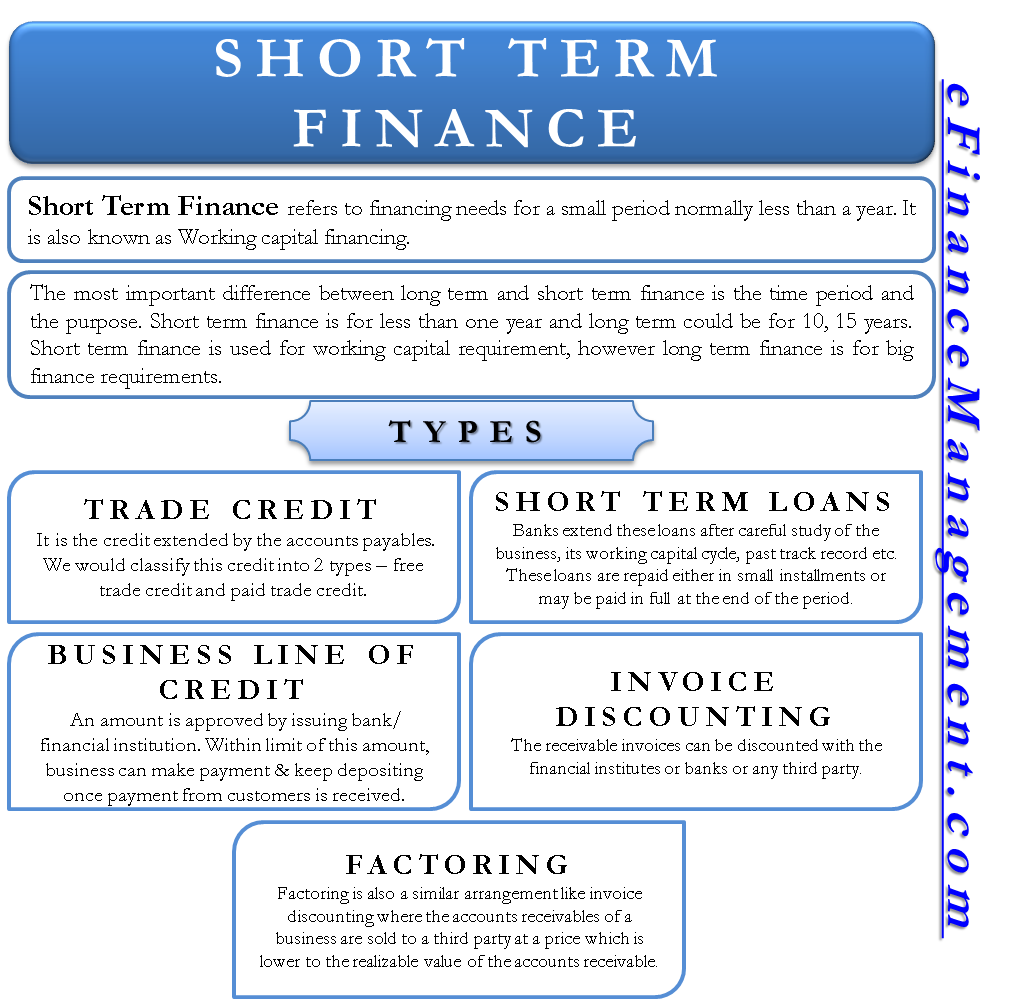

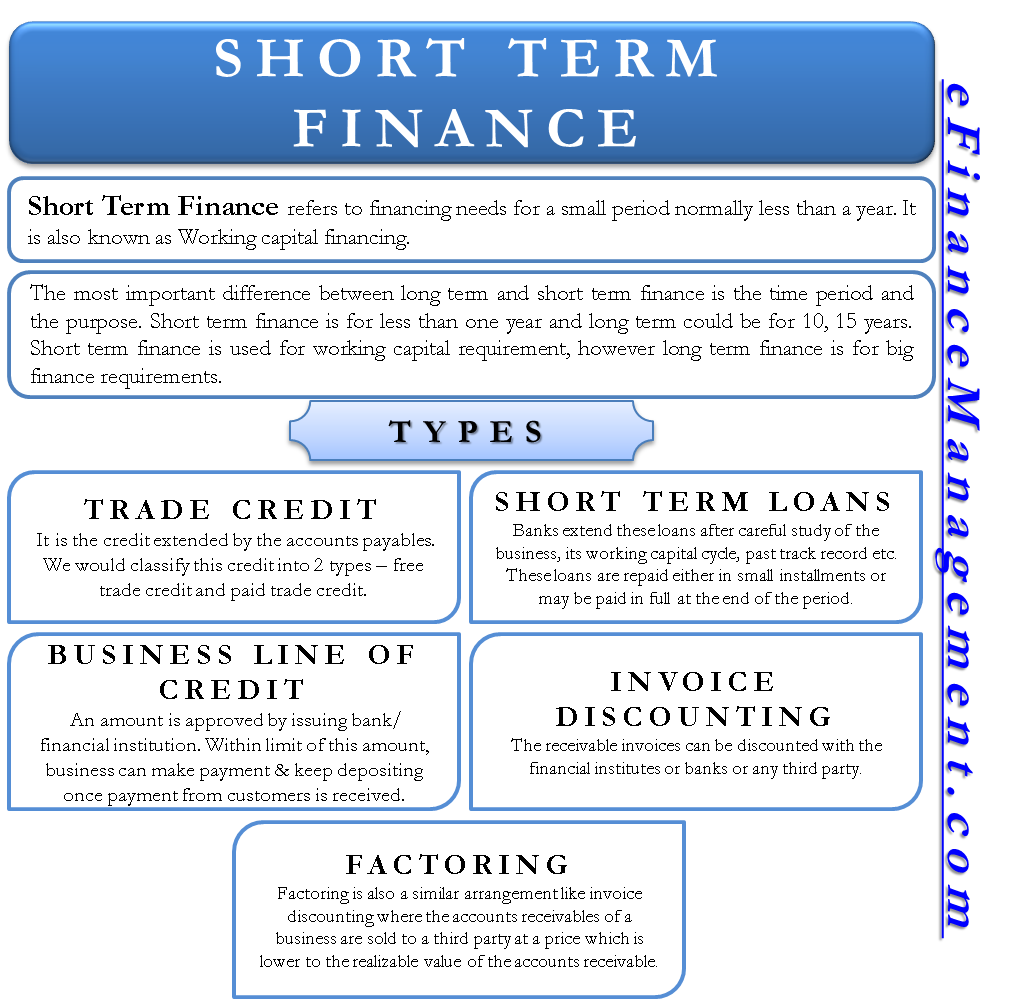

15 days later the credit card statement is sent in the post and the balance is paid by the business within the credit-free period. The main sources of short-term financing are 1 trade credit 2 commercial bank loans 3 commercial paper a specific type of promissory note and 4 secured loans. D explains why direct finance is more important than indirect finance as a source of business finance.

A cheaper source of finance as compared to other means such as bank credit. Short-term financing is most common for financing of current assets such as accounts receivable and inventories. Even if not substantial in total size compared to.

If you do not have family or friends with the means to help debt financing is likely the. Second support for bank finance is particularly relevant for the funding of fixed investment by SMEs which may play an important role in the transmission of. Bank lending is still mainly short term although medium-term lending is quite common these days.

Bank lending is still mainly short term although medium-term lending is quite common these days. When you can avoid financing from a formal source it will usually be more advantageous for your business. Not an important source of financing for small firms.

Hence we must also have an idea about the sources of finance. Short term lending may be in the form of. Protection against bad debts to the firm in case of non-recourse factoring.

This trade credit as it is. Factoring is a source of finance for small businesses. C would not arise if the owners of the firm had complete information about the activities of the managers.

A an overdraft which a company should keep within a limit set by the bank. But as a matter of fact the methods refer only to the forms in which the funds are raised and hence may or may not include the sources from or through which the funds are raised. The organization is relieved from the task of collection of bad debt.

At times the factor also provides finance to the company that is he makes advance payment of the debts taken by him to the firm. Protection against bad debts to the firm in case of non-recourse factoring. Normally the methods of raising finance are also termed as the sources of finance.

Co-operative Credit Societies- This source of credit is the most economical and important source of rural credit. First monetary policy measures predominantly aimed at supporting bank credit are crucial for SMEs in the light of their dependence on bank credit as the main source of external finance. In other words a cash-strapped business unable to get desperately needed funds sells off its invoices that.

Borrowings from banks are an important source of finance to companies. This market provides more funds at lower rates than other methods provide. Borrowings from banks are an important source of finance to companies.

Financing National Adaptation Plan Nap Processes International Institute For Sustainable Development

Personal Finance Exam True False Questions 1 Inflation Reduces

Financing National Adaptation Plan Nap Processes International Institute For Sustainable Development

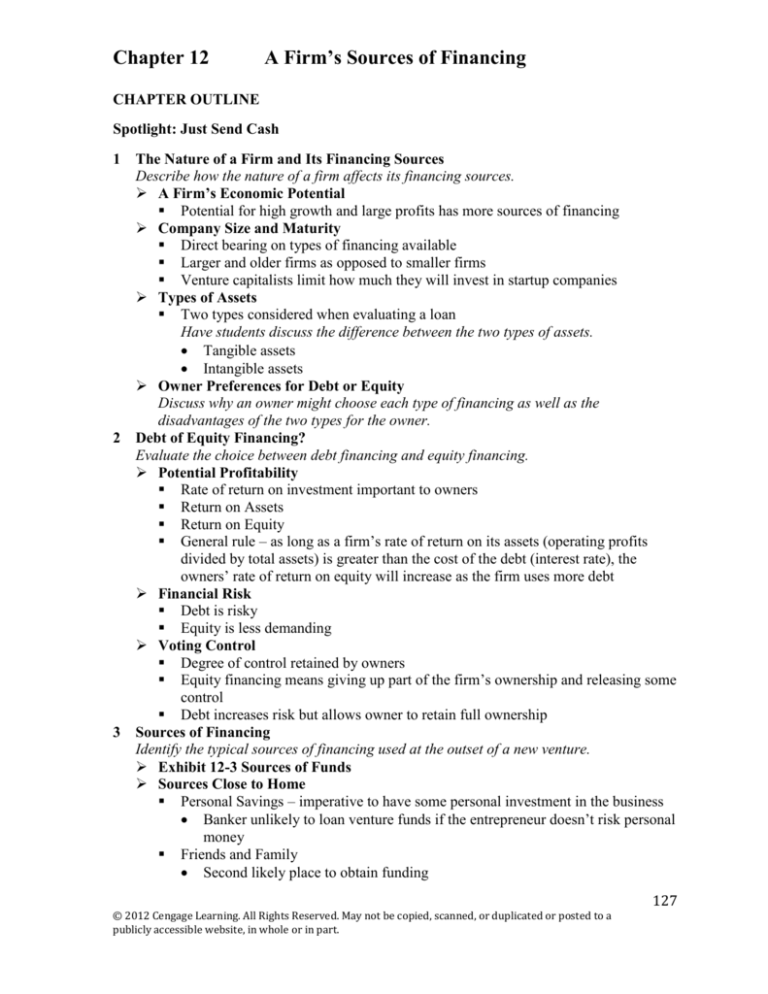

Chapter 12 A Firm S Sources Of Financing

Classification Of The Sources Of Funds Concepts Types And Examples

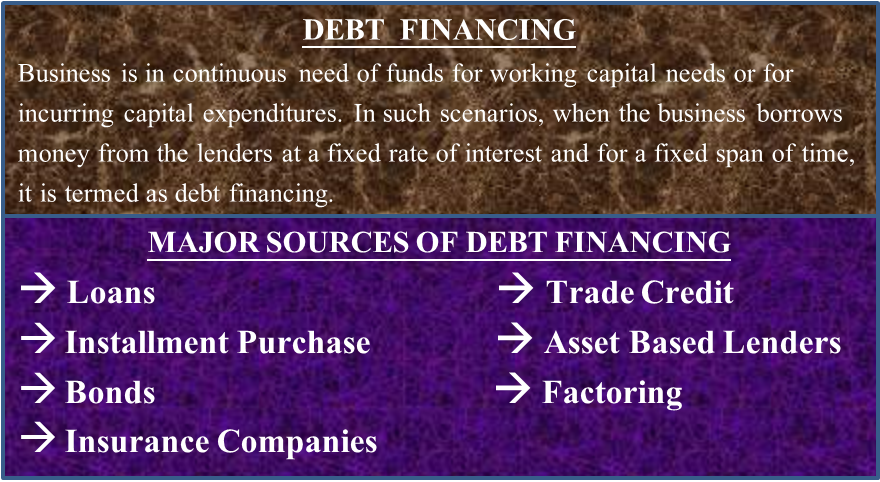

Sources Of Debt Financing Type Loan Trade Credit Factoring Bond Etc

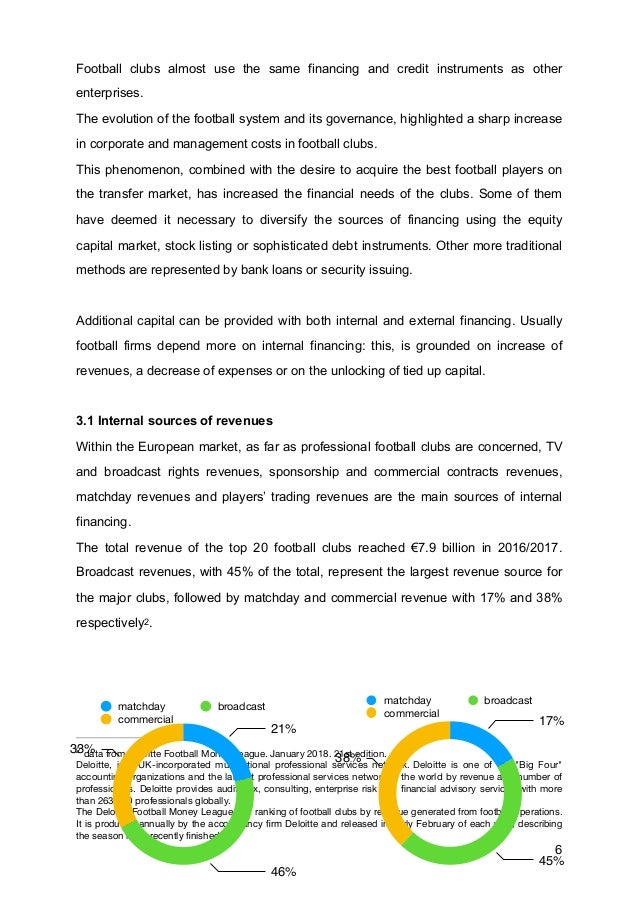

Sources Of Funding For Football Clubs In The European Market

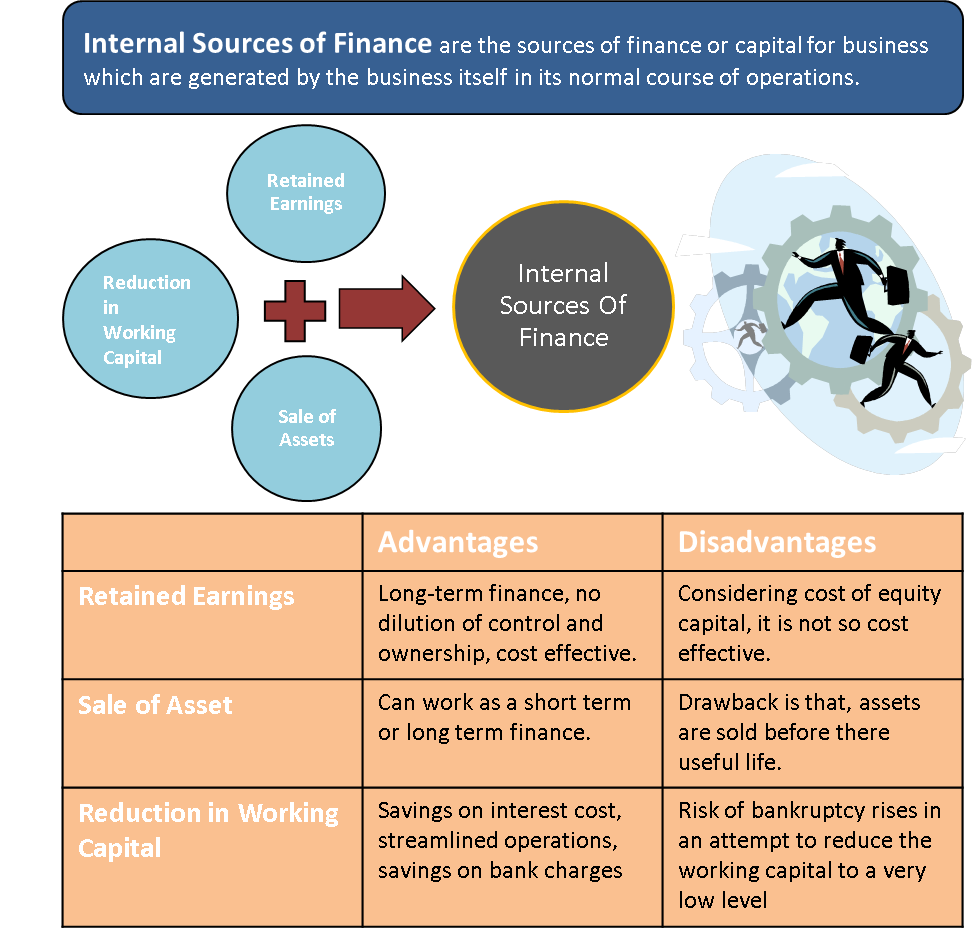

Internal Sources Of Finance Retained Profits Sale Assets Wc Reduction

Short Term Finance Types Sources Vs Long Term Efinancemanagement

0 Response to "credit provides an important source of financing for __"

Post a Comment